Roti, Kapda aur Makhan (15 Aug 1947 to 23 Mar 2020)

Roti, Kapda, Insurance aur Makhan (24 Mar 2020 Onwards)

A new necessity has been added along with the basic three – courtesy SARS-CoV-2 pet name Corona.

Remember this WhatsApp picture meme depicting the Year 2020?

Living with virus and natural calamities related uncertainties are going to be the new normal of our life.

(Statutory Warning) First: This is not meant for Super Humans who think that they are Healthy, Wealthy and Well Covered. This for common people.

I am a Mallu, Roma is Kannadiga and Gaurav is Gujju, hence we cannot write in Hindi but can confidently explain very well in our National Language as well as in Malayalam, Konkani, Gujarati & Marathi.

Today I would like to talk to you about the 4th Necessity in our Life – Insurance.

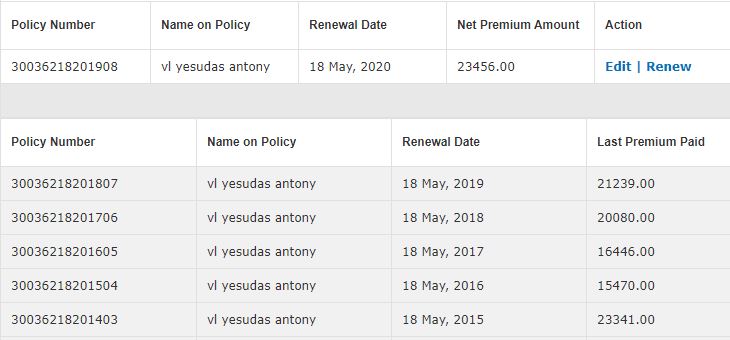

Even before corona, we always advised you to add MediClaim and Term Plan as part of your Wealth Creation and 99% of the people said it’s a WEALTH LOSS. I agreed to that because I preferred not to argue.

Trackfinder always kept Individual & Family MediClaim Insurance as the top priority in the Financial Planning Pyramid. Then comes Savings, Investments, Term Plan and Stocks. This is my philosophy of creating a legacy.

In the past 3 Corona months, we have come across very painful situations like suicides, huge medical expenses, job losses and so many deaths. We were mute spectators of that heart breaking events unfolding around us.

Many said it’s not in our control; it was an Act of God. Okay, I agree, though not completely. Few things were there in our control by the Grace of God, that could have protected us and our loved ones.

How??

By just adding a Health Insurance and a Term Plan Life Insurance. Today I thought of writing about this because of the regrets me and Roma had, watching some of our clients suffering due to corona’s carnage. Truly, I regret not forcing them to make both the plans as part of their portfolio.

Usual Statements are:

“I don’t need it NOW”

“I’m a Fitness Freak, I won’t Fall Sick”

“My Company is covering my medical expenses”

“I am in Armed Forces, I don’t need it”

“My in-laws, they will take care of that part, why should I bother”

“May be when I cross 45, now my Fit-Bit keeps a track of my health”

“It’s CSR is Poor, List of Hospitals less, PED Waiting Time is too much”

“Why Co-Pay and it’s a Foreign Company”

“2 Lakhs Medical Cover I have, ‘I think’ that is good enough”

“Mein Aj tak Kabhi Bimaar nahi padha and My parents also did not suffered any illnesses till date”

List is endless……

What you need to ask yourself is

“Does company cover me and my family sufficiently for our medical expenses?”

“Does company protect my family in the event of something untoward happens to me? And if Yes, What is that amount? Will it be adequate for my family to carry the same lifestyle?”

“Will my relatives and friends be chipping in to help us?”

“Who will pay for my Home Loan and Kids Education?” (Be very careful when you take a home loan as 99% of the lenders only think about their loss in your absence)

Here too, the list is endless……

Every working individual who cares for the family and also home loan & Business owners should have these Two by default, even if you find nothing left to save for the future. Remember, First step is the toughest; everything falls into place after that. The greater level of peace of mind gives you a psychological boost to work harder for saving and creating Wealth for the future. The ability to take Risk becomes a Pleasure if you are aware about the Reward and the Backup Plan. I know sometimes you don’t feel the need to buy them, but it’s never too late to think and talk to us about it.

One of my clients recently withdrew his entire investments for a Medical Emergency albeit me asking him to buy a Health Insurance about a year back. The pain is mutual.

Let me put them in perspective. What would you say if the Cost of Protecting your family starts with an Annual amount of Rs. 10000/=. Don’t wait for the life to slap you to take action, DO IT NOW!

In the last one and half decade we never proposed anything that we cannot buy for ourselves. We propose what we personally have with Us and could buy for our Kith & Kin. That has been the motto of Trackfinder Financial Consultancy.

We have all the products under the sun but what is good for me and my family will only be advised by us.

Now I don’t want you to hunt or Google to find one, I have it. I am there for you to get what you want and I will give you what I feel is right… It’s completely your prerogative to do what you want to do.

Wealth Creation isn’t a joke, neither the Legacy that we wish to build for you. Let’s Grow Together.

Co authored by Roman Miranda

Leave a comment