According to me, Wealth means – peace of mind, stamp of legacy, never ending income, things becoming inexpensive, luxury and leisure becoming part of your lifestyle and finally you are in the art of giving away. If this is what you visualize about yourself, then you need to alter the course of your day-to-day actions that makes you feel rich. Some of them are Intraday Trading, Cryptocurrency, Fixed Deposits, LIC policies, Soft Loans or Money Lending and Multiple Real Estate properties.

These are boastful psychological placebos to keep you away from the “real wealth” and keep you closer to relatives and friends. If they applaud your money management skills every now and then, take it for granted, you are feeling rich and not wealthy by far.

Believe you me, all the first-generation billionaires took an average 30 – 40 years to become where they are today. Be it Bill Gates, Rakesh Jhunjhunwala, Elon Musk, Mukesh Ambani, Warren Buffet, Narayana Murthy and Jeff Bezos. If you study their biography, things and actions that I mentioned above are just minor part of their portfolio.

This week I experienced two incidents, that prompted me to pen about a disturbing mindset that even some learnt people possess. I held the torch out to them, but they refused to run out of the tunnel. My torch will burn out sooner and I will have no energy to push them out into the light.

Case 1

99% Fixed Income Products & 1% MF and Stocks

This individual served in the armed forces for 20 years and recently retired with a corpus not good enough either to buy a house nor for educating and settling the next generation. His misunderstanding of the economy linked Mutual Fund and Stock Market and its fluctuating growth always scared the hell out of him.

The Economy, MF and Stocks have all grown exponentially in the last 2 decade and he has only grown poorer staying away from those.

When Ms. Roma asked him to experiment MF with 10% of money parked in fixed income instruments by creating a portfolio, he suffered palpitation.

He won’t change, I can’t change him. My teaching, motivational and convincing skills fell short. His actions could push the next generation into a stress to become wealthy.

Case 2

95% FD and Real Estate & 5% MF and Stocks

This is an HNI Family, widely recognized, respected and has powerful connections. Few weeks back, one member of the family, middle aged, hale and hearty, suddenly fell sick and underwent two major surgeries.

The unfortunate incident shook the families core beliefs about health and healthcare system and foundations on which they kept the wealth to grow. In the hour of need they realized that Real Estate and Land Bank they owned were useless since the most important parameter of liquidity wasn’t available with it.

I am rich, I know everything and I can manage it “Wala attitude” have forced me to take a step back from advising them about what needs to be done which could have saved them from blues and bruises. By the time scales fell from their eyes and they realized the inherent value of their Financial Advisor, the damage had already been done. Terribly I fail again, painfully standing and watching their plight.

Both the above cases have reiterated my stubborn stand of Asset Allocation, Periodical investment and Family Wealth and Health Protection plans.

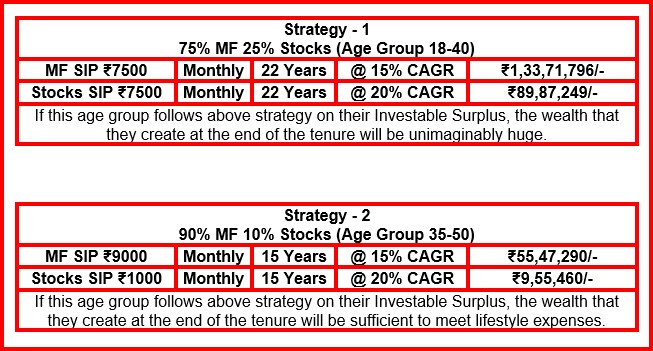

Today, I would like to share 3 strategies I use for my clientele.

On a serious note, I wish everybody follows this with me or without me.

Early bird catches the worms or more precisely “A Day late and a Rupee short”.

Unfortunately, this age group has lost an average 15 years of their initial earning period without investing in the right asset classes. Hence the strategy has to be risk deleveraged. Nonetheless they have an average 15 years to mitigate any risk due to factors governing the markets by taking this 10% high risk. This is a “Risk Bhi, Reward Bhi” wala method.

It is important to realize that your earning capacity is reducing and the liabilities are increasing. You cannot behave like superheroes. Unwittingly you created a family who cannot take your adventures with money. Any dereliction in asset allocation or a highly stock leveraging portfolio can jeopardize the corpus you are planning to create for all the inevitable goals. Many investors forget that they themselves are the first goal and rest of the family members are additional goals they created. Even without a family you have goal known as FIRE.

The Time has come near for you to relax and enjoy your Wealth. I am very sorry to say, you have a herculean task up ahead. You are neither rich nor poor, just some mismanagement brought you to this stage of Zero High Risk category.

You are most likely not going to create wealth until and unless you had an epiphany to do something like Col Sanders (62), Vera Wang (40) and Ray Kroc (50) who bloomed very late and became billionaires. The above 2 strategies are exclusively drafted for the first generation of wealth creators and you are probably not in that list.

Your primary concern should be preservation of what you have in hand and then help your kith and kin to fly high. Just want to be ruthlessly honest with you, if you are already Wealthy at 55 plus, you wouldn’t have been reading my blog. You would have had a battery of Wealth Managers who will be discussing hitherto unheard investment avenues.

This is also the age of reckoning. What you have done throughout your life reflects in your own and family’s lifestyle. However, it is never too late to change the DNA of generations to come. May you get to create an entrepreneur in your own right way.

Long and short of the thought is you have to plan your investments in a growing manner and not in a stagnant basket. Talk to Trackfinder Team for creating a portfolio and discuss the management methodology, time horizon and risk involved in it.

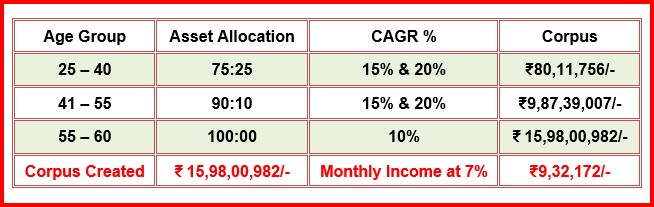

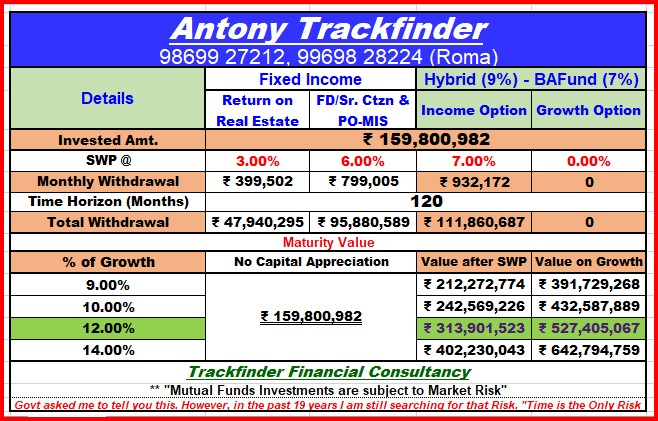

If an individual investor of 25-year-old starts SIP of ₹10,000 per month with Trackfinder Financial Services and if S/he follows our all three strategies from age 25 to 40 (aggressive) and then 41 to 55 (moderate) and restructure the same for monthly income (conservative) for next 5 years, you would be starting your monthly income at the age of 60 as mentioned below.

I am preparing my kids towards this. Only difference is I have started their investments at the age of 3 Years. Today I can proudly declare that many youngsters have started with me in their early stages of employment and now they have their kids’ investments too under the advisory of Trackfinder Financial Services. Some of them are 3rd generation investors.

One of the milestones that I proudly hold close to my heart is the holistic growth of my Team in terms of wealth creation and its protection. Average age of my team is 26 years. Average SIP of them is ₹13000. I can see them drawing a monthly income of ₹9 Lakhs at the age of 60.

Warm Regards

Antony Trackfinder

Founder and Chief Investment Advisor

Leave a comment