Location: Sensex, Shot-1, Take-25

This write up is purely pointed towards Individuals who are Millennials (1981-1996) and the Gen-Z (1997-2012).

Let me draw your attention to “what it would have been, had your parents invested”.

❇ Lump Sum investment of ₹1,00,000 x 25Yrs @ 20% PA = ₹95,39,622

❇ SIP investment of ₹10,000 x 12M x 25Yrs @ 20% PA = ₹3,82,02,950

I am giving this article a cinematographic touch. Hope it flashes memories on your personal silver screen.

Lights, Action, Camera!!!

When the camera starts rolling, you will see the glimpses from the past, actions of the present and crucial futuristic interpretation.

From the film Sholey to Harry Potter and the Star Trek to Baahubali, we have seen small becoming too BIG.

Well, then what is that small which could become the next BIG?? Iskeliye, “Advisor Zaroori Hai, Beedu.”

We have heard it a million times over the decades. Considering that phrase, what does it mean to be small and then one day find it to have magnified and become too big to our utter surprise?

Recently I had an interaction with few millennials who were surprised by the impact of an investment 25 years back, had their parents done it for them.

The process to invest, the vehicle to park and the willingness were present. What went missing was a Wealth Manager with a Vision.

It made them realize that a small parental help could have made a huge difference on their 25th birthday. It would not only have made the lives of these millennials comfortable but also in turn, the lives of their parents.

What Our Parents did!

They bought a house and sometimes multiple houses, got their sisters married, helped brothers get settled, bike and jewellery came home, generously donated to festivals, aimlessly bought multiple LIC policies… (Did I miss something? You may add it)

Hard questions are unwelcome not only at home but also in the society. Remember, it is an injustice to yourself, if you stay quiet and let the events playout. You are the one who is going to face the hard realities of tomorrow, not your parents or the society.

Tareekh pe tareekh… Tareekh pe tareekh… Tareekh pe tareekh … lekin jawab nahi mila.

Go back and look at the numbers I mentioned at the top, now ask yourself, would you have worked in a firm for your daily bread and your personal goals, had your parents did the right thing? For sure not!

From 1998 – 2023, you lost 25 years of Wealth Creation. Would you like to say the same in 2048? This is the actual reason for penning this article.

If you do not want to be left high and dry, trust my intuitions and start investing under our small cap portfolio.

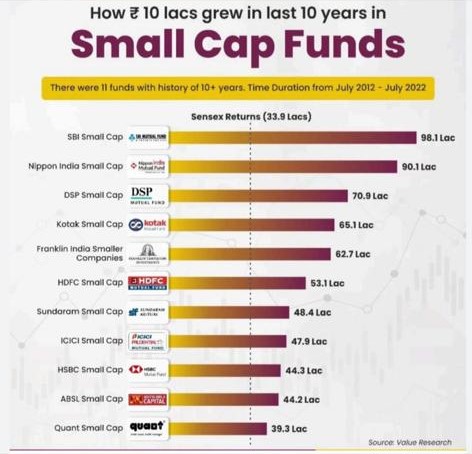

Before I call “Cut and Pack Up”. Let’s look at what the Small Cap funds did?

There are 2 dozen funds with us with incredible track record of performance investing in Sensex. Average return of them is 20% pa. If these returns were possible in the last 25years, what do you see in the next 25 years when India or Bharat will be in the top 3?

So, now is the time to revisit your portfolio and increase your exposure in the small cap category. (If you are investing with an Online Platform or without an Advisor, please spare me. I am only for people who trust Trackfinder.)

Trust me, Small is the next BIG!! We see it happening, you will see it too. So, SIP karwanu, Time diwanu…mazza ni life!!

How much should you invest? What should be your allocation? Whether I should do SIP or Lumpsum? Iss saare sawalon ka jawab Trackfinder Team k pass hai.

Contact me or get in touch with my team for further details. Let me “The End” with Danny Denzongpa’s dialogue about luck.

“Sahi time par sahi jagah hona, sahi time par sahi baat karna, aur sahi time par sahi kadam uthana, isi ko luck kehte hai.”

(Luck is all about taking the right step at the right time and at the right place.)

Roma – +91 9969828224, Akshay – +91 7777097212, Ruchita – +91 74004 06212, Dipesh – +91 74004 04212

Leave a comment