Small is the next BIG!!

Location: Every Home, Actors: Both Parents, Box Office: Children

Today is Children’s Day, hence let me share my thoughts about children from a parental perspective. Part of the Gen-Z and whole of Gen-Alpha will be impacted if wealth creation for the Next generation is not taken seriously by Parents.

Every time I speak to parents about “How much have you done so far for your kids?” Most of the answers are monotonous or ages old practices of savings which are theoretically and technically turns out to be practical jokes on the kids by the grown-ups.

1. This house is for them, what more they want?

2. I have done FD’s, RD’s and Sukanya Samrudhi for them.

3. I took a plot for them to use when they grow up.

4. 4 LIC policies are there, that will be sufficient for them.

5. I gave them education, now let them do it on their own.

When you, as a parent, declare this, you think that you have done your part.

What you want is an affirmation of your actions and a stamp of greatness without questions asked.

As children, do they have the right to know whether you have done the right thing in your so-called magnanimity?

Was it the best among many available to you?

Is this the legacy that I need to carry on building for the generations to come after me?

Parents do not like hard questions. Showing a mirror to them is considered blasphemous. Giving suggestions is a cardinal sin.

I have done some data and number crunching to understand what it takes to be a prudent parent. How simple is this? What is the result of “Taking a Simple Idea and Taking it Seriously”.

Doubting Parent = They do not trust anything in India. Hum Middle Class ke hai, vahi rahna hai. Hence, starts monthly RD or Sukanya Samriti for 15 years.

₹10,000 x 12M x 15Yrs @ 7% per annum = ₹31,28,000/-

Pareshaan Parent = They are over smart ones. I know everything. I will start, I will stop and I will start again. Hence, starts monthly SIP for 5 years and waits for 6 months to a year to take next decision.

₹10,000 x 12M x 5Yrs @ 10% per annum = ₹7,71,000/-

Society Parents = They are like Kuch toh karna hai. 10 sal ka SIP kaafi hai.

₹10,000 x 12M x 10Yrs @ 15% per annum = ₹26,30,000/-

Cool Parents = They trust system, economy, compounding and wealth creation. Hence starts monthly SIP for 15 years

₹10,000 x 12M x 15Yrs @ 18% per annum = ₹80,11,000/-

Wealthy Parents = They start investing for them first and then starts their Child’s investments from the first month of their birth.

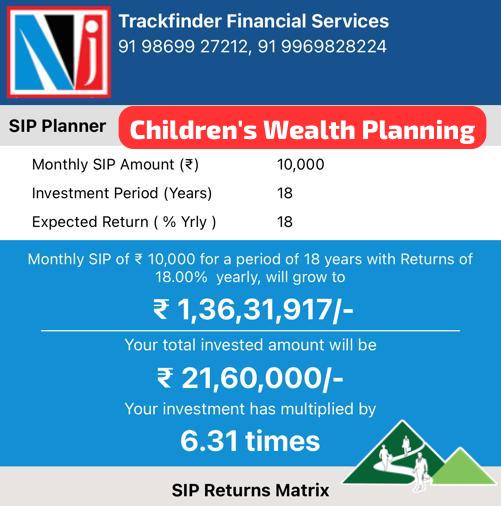

₹10,000 x 12M x 18Yrs @ 18% per annum = ₹1, 36,31,000/-

Trailor of the story is that a small parental action in the right direction could have made a huge difference on their 18th birthday. This “Young Adult” would have spoken like an entrepreneur and created a bigger legacy for you. “Mera bacha hai wala feelings hote.”

There are 2 dozen funds with us with incredible track record of performance investing in Sensex. Average return of them is 20% pa. If these returns were possible in the last 25years, what do you see in the next 25 years?

So, call my team and start your investments right today. Trust me, Small is the next BIG!! We see it happening, you will see it happen.

How much should you invest?

What should be your allocation?

Whether I should do SIP or Lumpsum?

Trackfinder Team can help you with this.

Warm regards,

Antony Trackfinder.

Leave a comment