Enough water has flown under the bridge of Thane Creek, so was the strength of the current of Nifty Index in the last Financial Year. There was never a moment of dullness. “Market has a mind of its own” this one-liner I have used more a dozen times to emphasize on the unpredictability of the rise and fall.

The only report that I am waiting to see at the beginning of the next year is the trading data of retail investors. Total number of demat accounts, total intraday traders, average profit made, number of intraday wizards who made profit, last but not the least, how much was their tax liability under STCG and LTCG.

“An ounce of prevention is worth a pound of cure.” Be it style, stress or sleep, I would like to follow this age-old adage. We at Trackfinder Financial Services LLP followed this to its letter and spirit.

Style Test

Style Test refers to the way you manage your earnings, expenses, savings and investments. From Albert Einstein to Sam Bankman, Warren Buffett to Chinese Investment Scam we have a million various methods to invest our hard-earned money to help it grow. All these gyan from sages and frauds boils down to one thing while making a decision to park your money is “Risk You Take”.

It is proven beyond reasonable doubt that “Wealth is in the Waiting”, Time is key, not the Timing”, and simple “Vanila ice cream is far better than Everything Bagel”. Style of investment is nothing but a way to weigh your appetite to lose money in the event of an unfavorable froth development inside makes everything to go belly up.

We maintained a 90:10 portfolio in favour of Mutual Funds for beginners. Ones who crossed half a million, we shifted to 80:20 by increasing the exposure in direct equity. For all the investors who are with valuations above ₹1 million we have created a portfolio consisting of 25% Stocks and 75% Mutual Funds. Style maketh a portfolio, a solid portfolio maketh you wealthy.

Follow the advisor. Give your unspent money and bottled-up emotions to my team for better management. I can guarantee you; the next two subtopics will help you navigate through bull and bear market seasons with élan. It will be an experience you never had while DIY-ing.

Stress Test

Stress Test – less said the better about this new nomenclature in financial industry. After Corona Test, this is the most discussed test among the elite. SEBI Chairperson Ms. Madhabi Buch called for a stress test to be conducted on the small cap funds and its liquidity factor. She has the right to pass an order. Burst a bubble or topple the apple cart for all I care. I, as an investor have just 2 questions.

- If these bottom of the pyramid companies aren’t worth a dime, why do you allow them to be listed on the browser and enjoy trading and valuations?

- If liquidity is a problem, then delist them or issue a blanket ban on investing public money in them.

A few days back when a retired Captain asked me about the trading and profitability quotient in stock market, my repartee made him laugh a bit louder.

This is what I said “Sir, the market will rise, fall and rise again with or without we being participants. What remains in us is BP induced heart conditions. That goes unnoticed and is worrisome.”

Stress can stretch your portfolio to look like a Mini-BSE. Last year, some new investors came to us with portfolios which looked like BSE and Mutual Funds Industry. Ms. Roma had a tough time analyzing, eliminating, clubbing, restructuring and placing it on the track under Trackfinder’s platform.

Stock Market is managed by professionals and if you think that you are too smart to manage these seasoned businessmen then you are living in a fool’s paradise.

Stress is a product purchased with knowledge. If you agree to disagree, drop the stress and move on. Do not hold it, let it slip through your fingers and make you feel light. If you don’t love a company do not buy. If you can’t hold it for the next 10 years, save that 10 minute of your time executing the order. Tension Lene Ka Nahi, (hello…) Dena Bhi Mat!

If you think that stress is injurious to health, why don’t you find some quality sleep?

Sleep Test

Sleep Test is one of the best Asthra I have in my quiver every time I find myself in an unfriendly frontier. Just sleep it off, 10 min of power nap is all that it takes to rejuvenate your wilting organs to back into its full capacity. A good night sleep is as important as good food and healthy lifestyle habits. If you just nodded your head or smiled in unison, then it is all the more important to make sure that you protect your sleep with all might.

While discussing emerging trends of investing in the Indian societies with Appu, my younger son, I said “one should not lose sleep over a portfolio crafted for wealth creation”.

“You mean to say, that PE thing, debt ratio, promotor holdings, and share prices are not to be checked every now and then?”

Yes boy, you have to check the vehicle condition before you sit in it for a long drive. Rain checks first, reinforcing the strategy next.

Why on earth should you buy some funds or stocks that you and your advisor are not very sure of?

Are they worthy enough to fit into the draft goal plan you created along with your advisor for you and your family?

Have you transferred the portfolio management risk to your advisor or to your own head?

I have been in this Financial Advisory Business for the past 22 years, the following things remained same then and even today.

“One Strategy, One Vision, One Mobile Number and One Routine.”

My friend Adv. Ms. Sakhi recently asked me, “It is year end and are you not busy? I want to speak to you. You cheer me up and I am missing that.” My response was, if you ever find me busy, then I am not doing my business right. If you find me not attending to calls when you reached out, I am in trouble doing some nonsense.

I love my Style and brand

I love my Stressfree life

I love my Sleep and dreams

Make this new Financial Year a year to remember. Make sure you celebrate a moment of glory in April of 2030.

Before I sign-off, let me share with you an information about how my team, few investors and my family are changing the progression of wealth building through new habits.

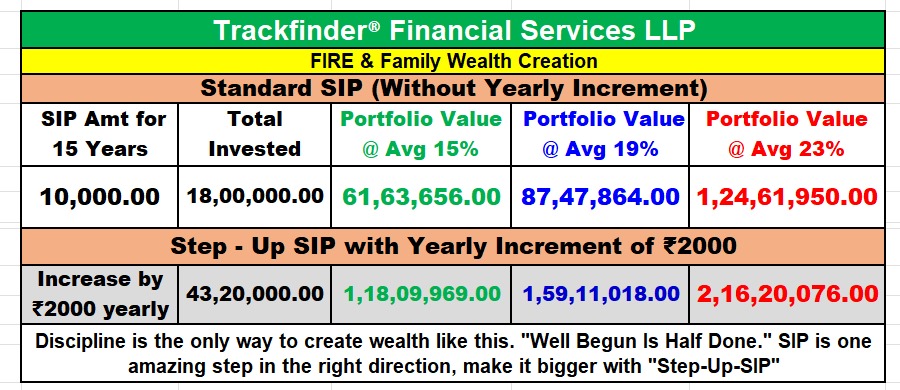

We are moving into a new-age-technology-based Step-Up-SIP.

Through this modus operandi you will give a yearly boost to the corpus you are creating. This above mentioned illustration will give enough food for thought and action thereof.

Talk to my team and start this from this year.

Also, I request you to be generous in giving a push to your friends and loved ones for starting their investing.

Simple savings may not suffice in a world where inflation and taxes are more than the traditional return on your savings in the Banks, Post Office. and PF.

Warm Regards

Antony Trackfinder

Leave a comment