A few days ago, I received a forwarded message that caught my attention. It highlighted how investors often struggle to assess the competence and integrity of their financial advisors. The message pointed out a common pitfall—investors falling prey to advisors who, despite being friends or acquaintances, may have dubious intentions. These advisors often rely on frequent personal contact and flattery to mask their incompetence, creating a false sense of trust. (If you close your eyes for a moment, you would see a few faces in this category, if you could relate to the points mentioned above, this write-up will make sense)

This insight sparked my thoughts and became the foundation for this blog.

Wealth management is often reduced to a game of numbers, credentials, and categorizations. However, true financial planning goes far beyond these surface-level metrics. It is a deeply personal process driven by individual goals, risk tolerance, and psychological responses. While fintech solutions and low-touch investing models gain traction, the human element in financial advisory remains irreplaceable. Separating genuine expertise from mere salesmanship is critical in an era where both technology and misinformation shape investor decisions. This perspective challenges conventional notions of wealth management, emphasizing the importance of behavioral finance, execution over qualifications, and the enduring value of trusted advisors.

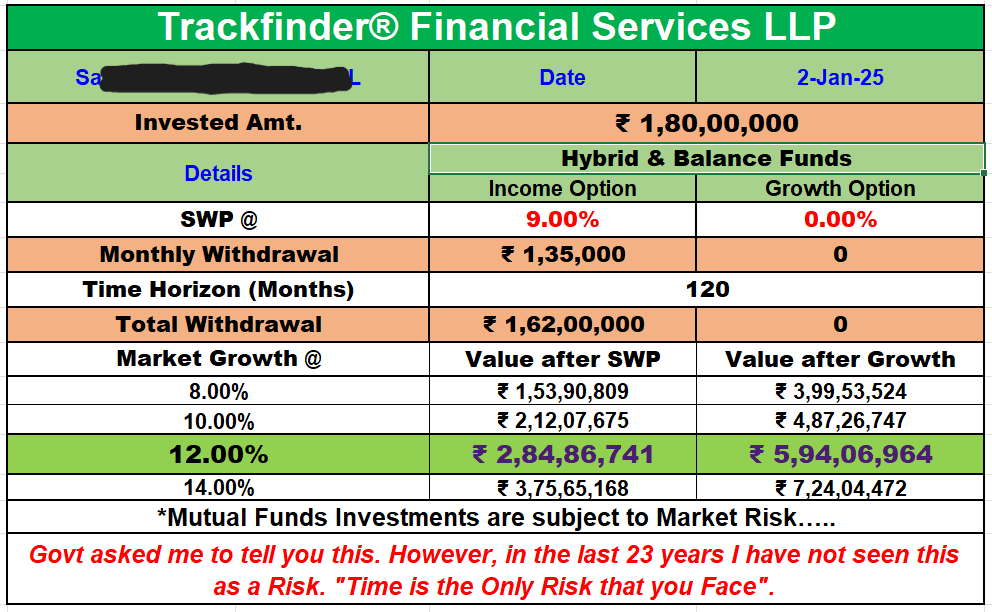

Wealth management should never be about categorizing clients based on their net worth. Instead, the only logical approach is to segment them by their goals and time horizons. Risk tolerance is deeply personal, shaped by individual circumstances, experiences, and psychological responses. Ignoring this reality in favour of arbitrary wealth brackets oversimplifies the complexities of financial planning.

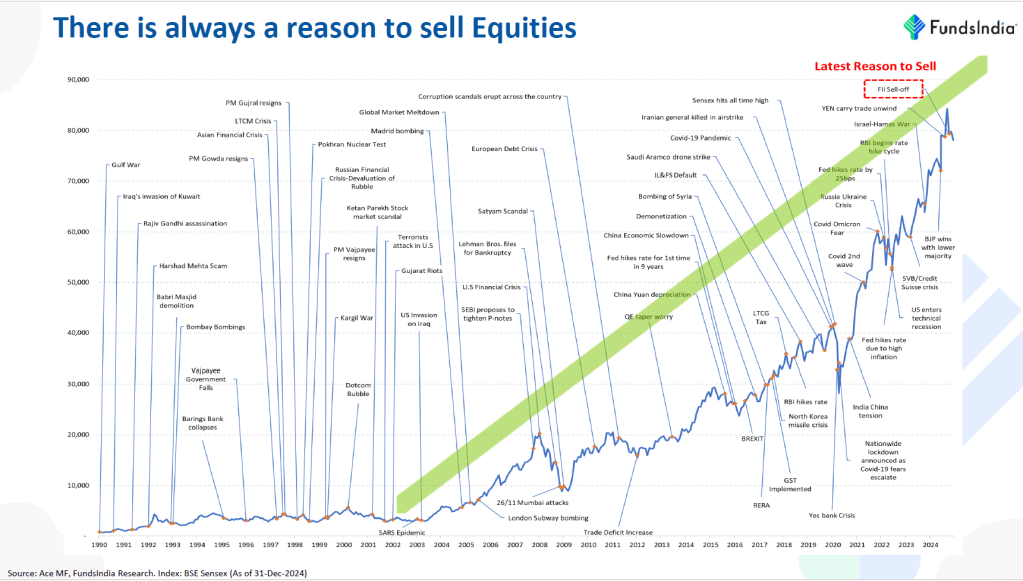

A major challenge in the industry comes from the influence of “persuasive salespeople” and well-meaning “friends and family” who, despite their lack of expertise or real skin in the game, often shape investment decisions. Their impact is rarely based on informed financial knowledge but rather on relationships and emotion-driven advice. This raises a crucial point: investor behaviour and behavioural finance play a defining role in wealth creation. The ability to navigate psychological biases and external noise can determine whether an investor builds sustainable wealth or falls into a cycle dictated by fleeting market sentiment.

Qualifications alone do not guarantee superior financial outcomes. While certifications like an RIA, CFP, or MBA in finance imply a certain level of technical proficiency, execution and real-world experience matter far more. A professional with only IRDA and NISM certifications but a deep understanding of markets and investor psychology can often deliver better results than someone with higher academic credentials but little practical insight. The proof lies in referral-based practices—where satisfied investors continue to bring in new clients after experiencing firsthand the value of strategic financial guidance, especially during periods of uncertainty.

The industry often makes the mistake of generalizing financial professionals into a single bracket, failing to distinguish between those who provide genuine value and those who simply follow a transactional approach. Separating the grain from the chaff is essential for ensuring that investors receive advice that is not just technically sound but also aligned with their long-term well-being.

Another missing piece in many discussions on financial planning is the evolving role of fintech solutions. While digital platforms offer efficiency and automation, the absence of human interaction in critical moments raises concerns. The younger generations—Gen Z, Gen Alpha, and beyond—may gravitate toward low-touch, technology-driven investment solutions, but the emotional reassurance of a credible advisor remains irreplaceable, particularly for Millennials and older investors. In times of uncertainty, when markets fluctuate and personal financial goals are at stake, human guidance makes all the difference.

True financial planning is not just about numbers, algorithms, or broad generalizations. It is about understanding human behavior, mitigating risks, and fostering long-term wealth creation through a mix of expertise, experience, and trust.

The advisory landscape is nuanced, and solutions must be equally tailored.

As viable solutions to the problems that is raised, an investor can consider the following before investing.

1. Verify Credentials and Expertise: Ensure the advisor holds relevant certifications and has a proven track record. Research their professional background and performance history.

2. Focus on Transparency: A trustworthy advisor should be transparent about fees, investment strategies, and potential conflicts of interest. Avoid those who rely heavily on flattery or vague promises.

3. Prioritize Performance Over Personality: While a friendly demeanor is nice, it should not overshadow the advisor’s ability to deliver results. Ask for concrete examples of how they’ve helped clients achieve their financial goals.

4. Seek Independent Reviews: Look for third-party reviews or testimonials from clients. This can provide a more objective perspective on the advisor’s competence and ethics.

5. Set Clear Expectations: Establish clear goals and metrics for success. A good advisor should align their strategies with your financial objectives, not their own agenda.

6. Educate Oneself: Take the time to learn basic financial principles. This will empower the investor to ask informed questions and better evaluate the advice they receive.

Ultimately, the goal should be to maximize long-term financial security for the investors

Investment advices are subject to credibility of the advisor. Choose your financial advisor wisely

Warm regards,

Antony, The Wealth Farmer

Instagram & YouTube

@wealthfarmerantony

Leave a comment