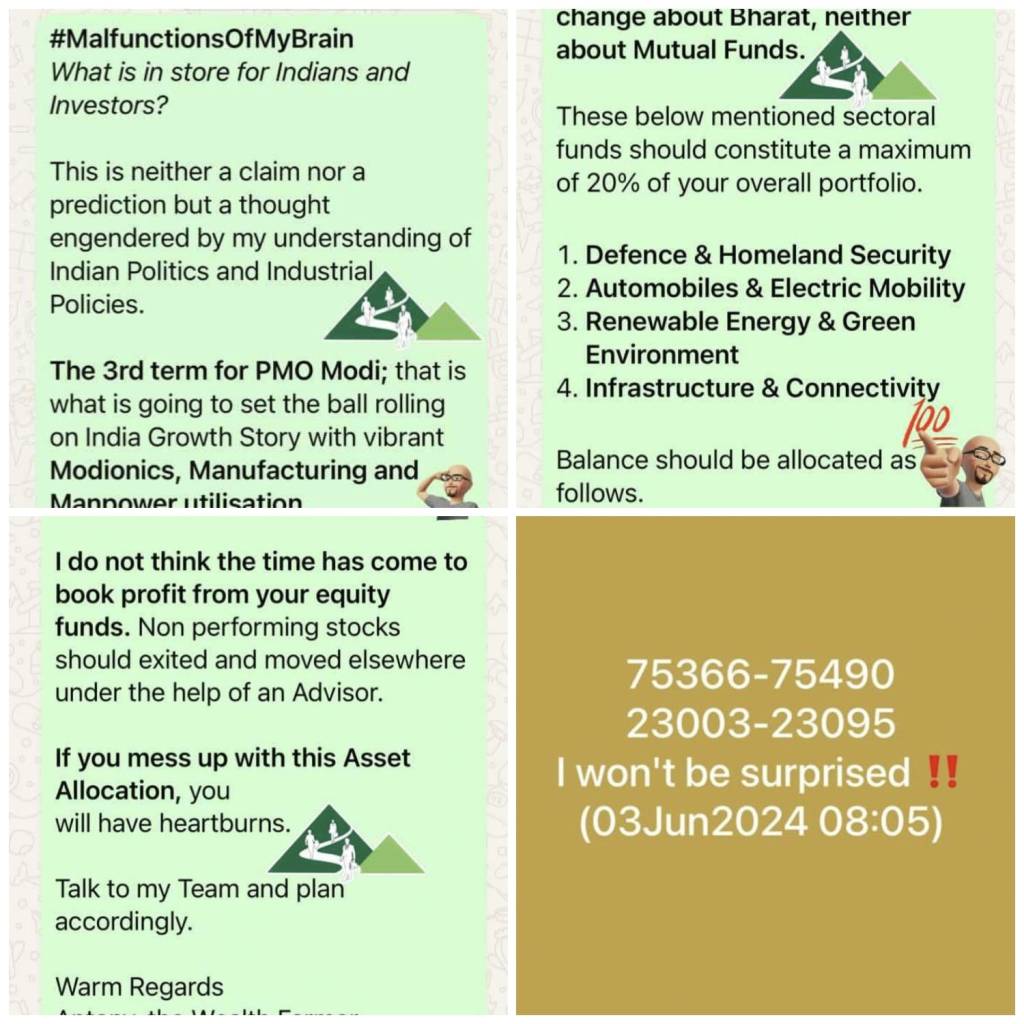

This is neither a claim nor a prediction, but a thought engendered by my understanding of Indian politics, industrial policy, and the long arc of economic strategy. A perspective from the Wealth Farmer’s desk. A part of this was written and broadcasted on 03 June 2024.

Indians Electoral Third Act: The Modi Mandate and Bharat’s Big Leap

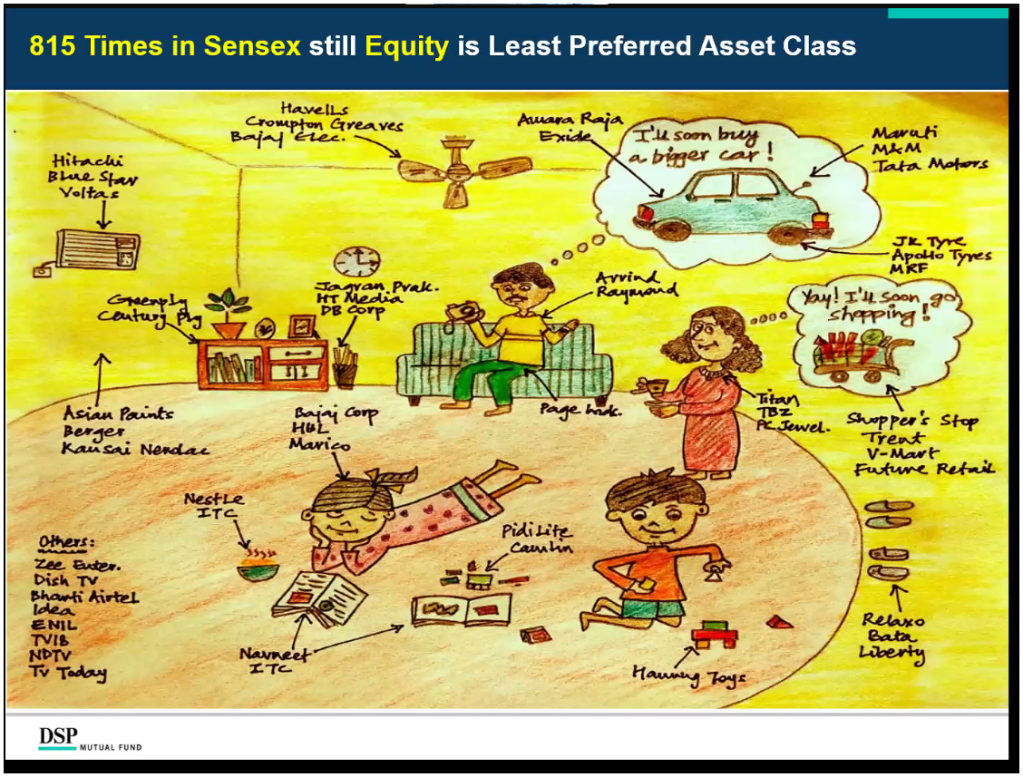

With the third term of Prime Minister Narendra Modi, the Indian growth engine is once again gaining momentum. We are now witnessing the crystallisation of what I like to call the Modionics Era—a cocktail of high-powered Manufacturing, empowered Manpower, and mission-mode Modernisation.

From defence corridors to digital highways, India is not just preparing for the future—it is constructing it. The blueprint was laid in the past decade; now, the foundations are being reinforced. Investors who can read these economic footprints will see that the Indian Growth Story is not a flash in the pan—it is a structural, generational story.

Despite global headwinds and domestic volatility, the vision remains clear. India is on track to stamp its authority on the global economic landscape over the next five years.

June of 2024 to June of 2025 Stock Market Movements: A Reality Check

Exactly a year ago, I wrote about the four funds I believed would become the next big wealth builders. Back then, the Sensex stood at 75,000—it went on to touch 85,000 by September, only to return to the 75K range by Jan 2025 only to go further down to 73K in March. From euphoria to exuberance—and then palpitations to self-doubt ruled in this year-long soap opera.

It’s a cycle every serious investor must learn to endure and decode. We’ve seen FOMO (Fear of Missing Out) turn into FAFO (Fool Around and Find Out). Investors who misunderstood volatility as a verdict instead of a phase are now licking their wounds.

But here’s the lesson: Valuations are temporary. Conviction is permanent.

Sectoral Allocation: Wealth Farming the Indian Way

The four sectors I highlighted last year have not just remained relevant—they’ve gained strength:

1. Defence & Homeland Security – With increased budget allocation and indigenous R&D pushes (DRDO, Make in India), this sector has seen a sharp uptick in investor interest.

2. Automobiles & Electric Mobility – EV penetration is now a policy mandate. Battery tech, charging infrastructure, and green subsidies are driving the transition.

3. Renewable Energy & Green Environment – Solar and hydrogen energy stocks have delivered consistent gains, and the government’s PLI schemes are bearing fruit.

4. Infrastructure & Connectivity – Capex-heavy budgets, Bharat Mala, and Digital India 2.0 are setting the stage for another infrastructure wave.

These sectoral funds should form no more than 20% of your mutual fund portfolio. The ideal asset allocation recommended considering the above is as follows: 75% in diversified equity funds aligned with broader indices and 5% in Gold ETFs as a hedge against volatility and geopolitical surprises. Having penned these, one must not forget the FIRE and Family goals planned with your Financial Advisor, Wealth Managers or the Mutual Funds Distributors.

My eyes are still trained on one of the emerging sectors in India, an underdog now, Artificial Intelligence and Forensic Science.

The Logic of Deductions: A Wealth Farmer’s Core Belief

Investing is not about prediction; it’s about pattern recognition. The markets are 80% IQ and 20% EQ—but those 20 points of emotion often cause 80% of the damage.

“When the going gets tough, even the tough get confused if they don’t know what they’re holding.”

In times of rapid market movement, don’t confuse correction with collapse. Panic is expensive.

What Should You Do in These Times?

If you’re asking “What now?”, then this is for you:

1. Work hard – Income is the seed of every wealth building plan.

2. Delay gratification – Compounding favours the patient, not the impulsive.

3. Save with discipline – Every rupee saved is a future soldier of financial freedom.

4. Insure wisely – Cover your family and your dreams with Term Plan, Health Insurance, & PA Cover.

5. Avoid get-rich-quick traps – They usually end with “quick broke”.

6. Follow humans, not hype – Seek advisors, not algorithms.

7. Read. Debate. Reboot. – Knowledge is the only inflation-proof currency.

Looking Ahead: The Market in the 90s?

I wouldn’t be surprised if we see the Sensex in the 90,000s by next year. That isn’t a bet, it’s a belief built on policy, productivity, and people.

The Indian economy is intact. The mutual fund story is strong. And my belief in Bharat is unshaken.

If you mess up with asset allocation, the markets will teach you the hard way. Don’t let that happen. Talk to my team. Sit with your advisor. Plan with purpose.

Warm regards,

Antony – The Wealth Farmer

Thank you #DSPMutualFund, #EconomicTimes, #NJWealth, #FundsIndia, #GOI and my team.

Leave a comment